Lithium, the least dense of all metals, was discovered in 1817 by Swedish chemist Johan August Arfwedson. Since then, lithium and its compounds have been used in products from psychiatric medicine to lubricating grease. However, interest in lithium has exploded in recent years because of its use in rechargeable batteries for electric and hybrid-electric cars, energy storage systems, lawnmowers, power tools and more. Lithium batteries also power laptops and cell phones due to their high charge density and lightweight.

The U.S. will need far more lithium to achieve its clean energy goals. The mineral companies that mine, extract and process the chemical element are set to grow. However, these mining companies are encountering resistance to their production expansion from environmental & indigenous groups, and government regulatory agencies.

Worldwide annual demand for lithium was about 350,000 tons (317,500 metric tons) in 2020.1 Despite expectations that lithium demand will rise from approximately 500,000 metric tons of lithium carbonate equivalent (LCE) in 2021 to some three million to four million metric tons in 2030, McKinsey & Company believe that the lithium industry will be able to provide enough product to supply the rapidly growing lithium-ion battery industry.2

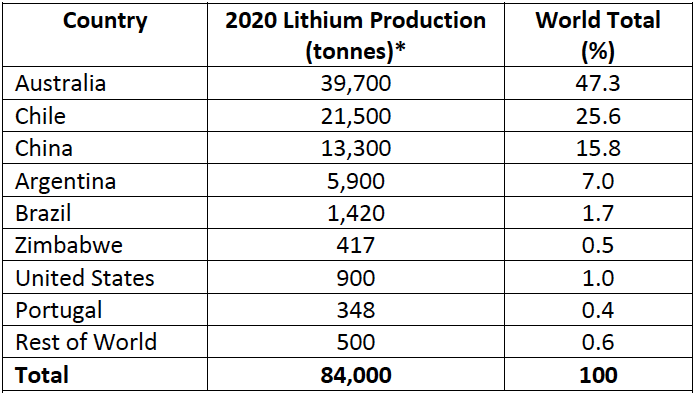

Currently, almost all lithium mining occurs in Australia, Latin America, and China accounting for roughly 97% of the world’s lithium used for lithium-ion batteries.

Although lithium reserves are distributed widely across the globe, the U.S. is home to just one active lithium mine, in Nevada. However, new and potential lithium mining and extracting projects are in various stages of development in states including Maine, North Carolina, California, Utah, and Nevada. New global mining projects will likely introduce new players and geographies to the lithium-mining map. This anticipated additional capacity base should be enough for supply to grow at a 20 percent annual rate to reach over 2.7 million metric tons of lithium carbonate equivalent by 2030.

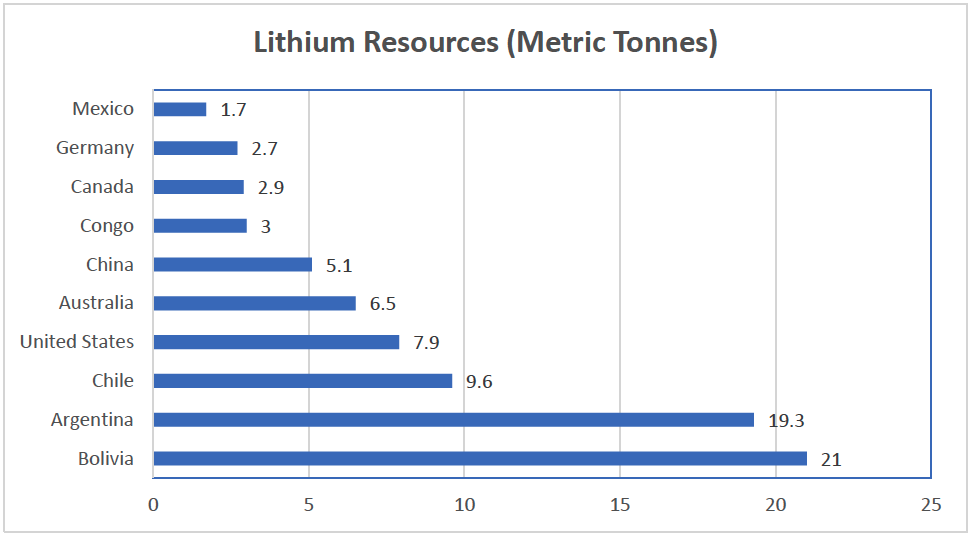

The largest resources in the world are in the Bolivia-Argentina-Chile “lithium triangle” which accounts for 58% of the planet’s known resource. With 49.9 million metric tons (MT), the “lithium triangle” is the world’s largest known lithium resource. This puts these South American countries ahead of Australia (6.4 million MT), and China (5.1 million MT). Global lithium resources are estimated at 86 million MT, and continental brines and pegmatites (hard-rock ore) are the main sources for commercial production.4

Lithium was first discovered in the mineral petalite. Lepidolite and spodumene are other common minerals which contain lithium. Commercial quantities of these three minerals are in a special igneous rock deposit that geologists call pegmatite. Lithium is mined from three types of deposits: brines, pegmatites and sedimentary rocks.5

The element is critical to development of rechargeable lithium-ion batteries that are seen as key to reducing climate-changing carbon emissions created by cars and other forms of transportation.

Expanding domestic lithium production would involve open pit mining or brine extraction, which involves pumping a mineral-rich brine to the surface and processing it. Opponents including the Sierra Club have raised concerns that the projects could harm sacred Indigenous lands and jeopardize fragile ecosystems and wildlife. However, the projects could also benefit the environment in the long run by getting fossil fuel-burning cars off the road.6

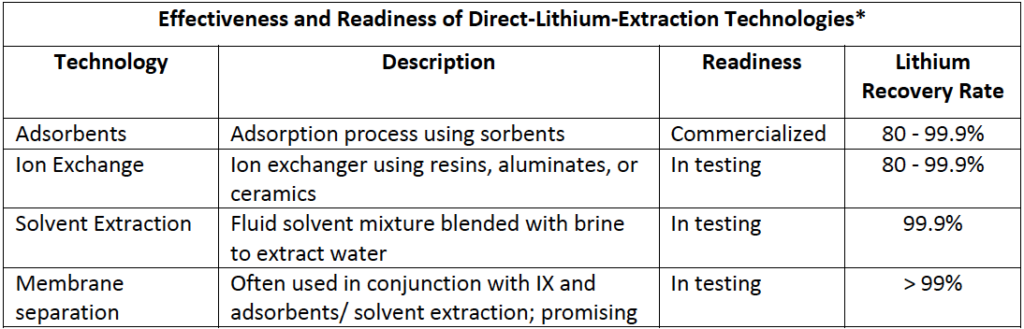

For brines to succeed as a source of lithium supply, a proven process for DLE will be required. Currently, extracting lithium from brines involves pumping the brines into a series of evaporation ponds, crystallizing the other salts out of the brine and leaving behind a lithium-rich liquor in a process that can take up to two years.7 There are several companies testing various DLE approaches. While their ideas differ, the concept remains the same: letting the brine flow through a lithium-bonding material using adsorption, ion-exchange, membrane-separation, or solvent-extraction processes, followed by a polishing solution to obtain lithium chloride or lithium sulfate. These can be further processed to remove impurities before conversion into lithium carbonate or lithium hydroxide.

DLE has several potential benefits, including:8

To date, only adsorption DLE has been used on a commercial scale, in Argentina and China.9 If DLE can be scaled up and spread across brine assets, it will boost existing capacities via increased recoveries and lower operating costs, while also improving the sustainability aspects of operations. There are five different types of direct-lithium extractions technologies.

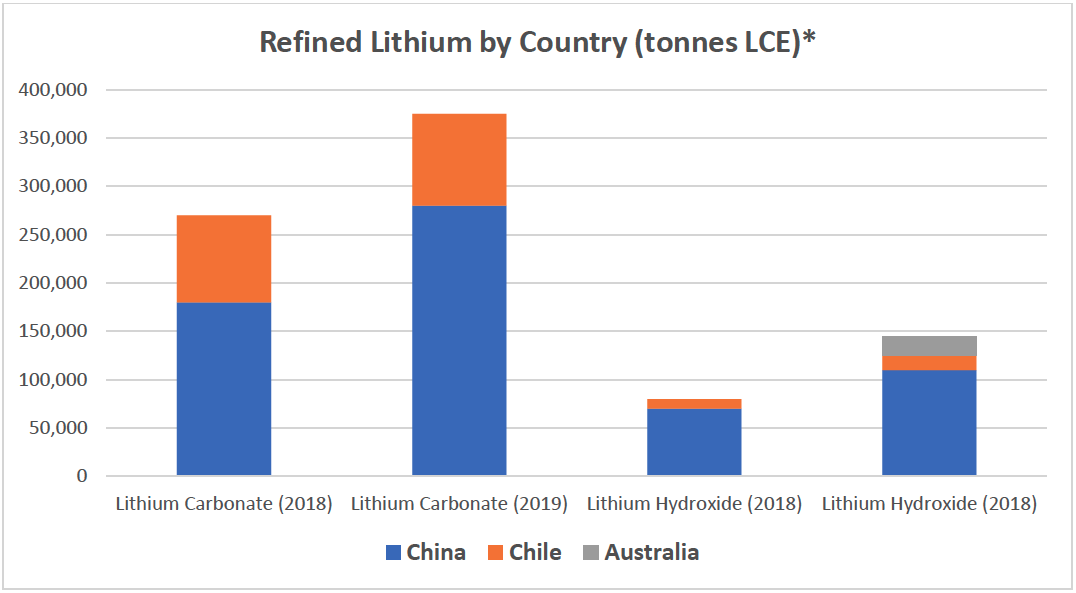

Lithium is currently produced and sold in two main forms – lithium carbonate which is largely produced from brines and lithium hydroxide that is mainly produced from hard rock sources. China accounts for the majority of the refined lithium chemicals, both lithium carbonate and lithium hydroxide.

The element is critical to development of rechargeable lithium-ion batteries that are seen as key to reducing climate-changing carbon emissions created by cars and other forms of transportation. Today, majority of the lithium is used to make lithium-ion batteries for electric cars and mobile devices.

The EV revolution and the corresponding significant growth of lithium-ion batteries increased the demand for lithium and became the dominant use in 2017.10 With the surge of lithium demand in batteries in the 2000s, new companies have expanded lithium production from hard rock sources and brine isolation efforts to meet the rising demand.11

In 2010, less than 30 percent of lithium demand was for batteries; the bulk of demand was split between ceramics and glasses (35 percent) and greases, metallurgical powders, polymers, and other industrial uses (35-plus percent). By 2030, batteries are expected to account for 95 percent of lithium demand, and total needs will grow annually by 25 to 26 percent to reach 3.3 million to 3.8 million metric tons of lithium carbonate equivalent.12 Over the next decade, McKinsey & Company forecasts continued growth of Li-ion batteries at an annual compound rate of approximately 30 percent. By 2030, EVs, along with energy-storage systems, e-bikes, electrification of tools, and other battery-intensive applications, could account for 4,000 to 4,500 gigawatt-hours of Li-ion demand.

Lithium is the driving force behind electric vehicles, but will supply keep pace with demand? A typical electric car battery bank needs approximately 25 pounds (11.4 kg) of lithium. If nothing changes in either usage or reserves, there’s adequate supply of lithium to produce 1.8 billion vehicles.13

The Biden administration set an ambitious goal for half of new car sales to be electric, fuel cell or hybrid electric vehicles by 2030. If half of all cars sold by 2030 were electric, EVs could make up between 60%-70% of cars on the road by 2050.

Less than 1% of the 250 million cars, SUVs and light-duty trucks on the road in the United States are electric. The administration said that getting drivers to switch from gas-powered to electric vehicles (EVs) is essential for the U.S. to be carbon-neutral by 2050. However, changing the composition of vehicles on the road will be a slow process because only about 17 million new cars are sold each year.

Sales estimates of new EVs vary widely due to the uncertainty around local adoption rates, purchase prices and incentives, among many other factors. By 2035, about 45% of new car sales could be electric according to industry analysis IHS Markit. At this rate, about half of the cars on the road would be electric by 2050.

Electric vehicle (EV) sales grew by around 50 percent in 2020 and doubled to approximately seven million units in 2021. At the same time, surging EV demand has seen lithium prices rise by around 550 percent in a year. Nevertheless, momentum is certainly building for the transition to electric. Automakers are ramping up EV production and many new models are expected over the next few years.

However, about half of adults who are aware of electric vehicles say they are unlikely to seriously consider purchasing one, according to a Pew Research Center survey from June. Consumers hesitant to make the switch cite concerns such as the high purchase price, limited driving range and lack of sufficient charging infrastructure.

Lithium is needed to produce virtually all traction batteries currently used in EVs as well as consumer electronics. Lithium-ion (Li-ion) batteries are widely used in many other applications as well.

Battery storage systems are emerging as one of the key solutions to effectively integrate solar and wind renewables in power systems worldwide. A recent analysis from the International Renewable Energy Agency (IRENA) shows how electricity storage technologies can be used for a variety of applications in the power sector.

Utility-scale batteries, for example, can enable a greater feed-in of renewables into the grid by storing excess generation and by firming renewable energy output. Furthermore, particularly when paired with renewable generators, batteries help provide reliable and cheaper electricity in isolated grids and to off-grid communities, which otherwise rely on expensive diesel fuel for electricity generation.

Presently, utility-scale battery storage systems are mostly being deployed in Australia, Germany, Japan, United Kingdom, the United States and other European countries. One of the larger systems is the Tesla 100 MW/129 MWh Li-ion battery storage project at Hornsdale Wind Farm in Australia. In New York state, a high-level demonstration project using a 4 MW/40 MWh battery storage system showed that the operator could reduce almost 400 hours of congestion in the power grid and save up to $2 million in fuel costs.

In addition, several island and off-grid communities have invested in large-scale battery storage to balance the grid and store excess renewable energy. In a mini-grid battery project in Martinique, the output of a solar PV farm is supported by a 2 MWh energy storage unit, ensuring that electricity is injected into the grid at a constant rate, avoiding the need for back-up generation. In Hawaii, almost 130 MWh of battery storage systems have been implemented to provide smoothening services for solar PV and wind energy.

Globally, energy storage deployment in emerging markets is expected to increase by over 40% each year until 2025. Currently, utility-scale stationary batteries dominate global energy storage. But by 2030, small-scale battery storage is expected to significantly increase, complementing utility-scale applications.

The behind-the-meter (BTM) batteries are connected behind the utility meter of commercial, industrial or residential customers, primarily aiming at electricity bill savings. Installations of BTM batteries globally is on the rise. This increase has been driven by the falling costs of battery storage technology, due to the growing consumer market and the development of electric vehicles (EVs) and plug-in hybrid EVs (PHEVs), along with the deployment of distributed renewable energy generation and the development of smart grids. In Germany, for example, 40% of recent rooftop solar PV applications have been installed with BTM batteries. Australia aims to reach one million BTM batteries installations by 2025, with 21 000 systems installed in the country in 2017.

Overall, total battery capacity in stationary applications could increase from a current estimate of 11 GWh to between 180 to 420 GWh, an increase of 17- to 38-fold.

All-electric vehicles, plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs) typically produce lower tailpipe emissions than conventional vehicles do. When measuring well-to-wheel emissions, the electricity source is important: for all-electric vehicles and PHEVs, part or all of the power provided by the battery comes from off-board sources of electricity. There are emissions associated with the majority of electricity production in the United States.

All-electric vehicles and PHEVs running only on electricity have zero tailpipe emissions, but emissions may be produced by the source of electrical power, such as a power plant. In geographic areas that use relatively low-polluting energy sources for electricity generation, all-electric vehicles and PHEVs typically have lower emissions well-to-wheel than similar conventional vehicles running on gasoline or diesel. In regions that depend heavily on coal for electricity generation, EVs may not demonstrate a strong well-to-wheel emissions benefit.

Vehicle emissions can be divided into two general categories: air pollutants, which contribute to smog, haze, and health problems; and greenhouse gases (GHGs), such as carbon dioxide and methane. Both categories of emissions can be evaluated on a direct basis and a well-to-wheel basis.

Conventional vehicles with an internal combustion engine (ICE) produce direct emissions through the tailpipe, as well as through evaporation from the vehicle’s fuel system and during the fueling process. Conversely, all-electric vehicles produce zero direct emissions. PHEVs produce zero tailpipe emissions when they are in all-electric mode, but they can produce evaporative emissions. When using the ICE, PHEVs also produce tailpipe emissions. However, their direct emissions are typically lower than those of comparable conventional vehicles.

Well-to-wheel emissions include all emissions related to fuel production, processing, distribution, and use. In the case of gasoline, emissions are produced while extracting petroleum from the earth, refining it, distributing the fuel to stations, and burning it in vehicles. In the case of electricity, most electric power plants produce emissions, and there are additional emissions associated with the extraction, processing, and distribution of the primary energy sources they use for electricity production.

The Energy Efficiency and Renewable Energy Office of the US Department of Energy calculated that the average annual emissions nationwide of an EV is 3.932 Pounds of CO2 Equivalent, whereas for a PHEV the emissions are 5.799 Pounds of CO2 Equivalent, and 11.435 Pounds of CO2 Equivalent. Consequently, EVs emit approximately 34% of the total amount of CO2 as a gasoline powered vehicle. Even in West Virginia that uses coal as its primary electric production fuel (90.9%), EVs use 9.146 Pounds of CO2 Equivalent, still below that for a gasoline powered vehicle; 11.435 Pounds of CO2 Equivalent.

It has been argued that lithium will be one of the main objects of geopolitical competition in a world running on renewable energy and dependent on batteries, but this perspective has also been criticized for underestimating the power of economic incentives for expanded production.14

A frequently asked question is whether lithium-ion batteries can be recycled. With expected battery lifetimes of around 10 to 15 years for passenger vehicles, and the possibility of extending EV battery life through use in the energy-storage sector, battery recycling is expected to increase during the current decade, but not to game-changing levels. Depending on the recycling process employed, it is possible to recover between zero and 80 percent of the lithium contained in end-of-life batteries. By 2030, such secondary supply is expected to account for slightly more than 6 percent of total lithium production.

Another question that arises is whether lithium can be substituted. Most grid storage applications have other developed technologies that would be adequate for the application: vanadium redox flow, zinc air, sodium sulfur, sodium nickel, etc. However, there is currently no substitute for lithium to meet the demands of the transportation sector. Presently, the only potential alternative is sodium ion, which, when commercialized, will only be able to handle low-performing applications. Therefore, there is little risk of lithium demand decreasing by 2030.

In summary, lithium will be an essential mineral needed if US is to achieve its clean energy goals. Lithium demand is expected to grow significantly due to the EV revolution and it’s increased use in batteries for vehicles, solar and wind storage and other consumer applications such as phones, laptops and BHM. The success of lithium mining being able to satisfy this rapidly growing demand depends on the success of many new lithium mining projects and the ability of governments to support tapping into their existing lithium reserves at an accelerated pace.